The signs of a recession in 2023 become constantly more evident.

Of course, no one can know for sure what will happen in the future, but we can still analyze what’s going on, week by week, to provide information about what happens in the world – and specifically in the fintech sector.

During the past weeks, we talked about the developments in the economic and financial environment, both in our articles and FTW Weekend newsletter. To recap:

- Fed Raises Interest Rates (Again) – What’s Next?

- What Inflation Means For The Labor Market

- Inflation Affects the Labor Market – FTW Weekend #3

We found some similarities with the 2008 crisis, and analyzed the possible consequences of Fed’s decisions on the labor market – even if the US labor market still offers more jobs than available workers.

The phase we’re currently witnessing tells us that even if the labor market is still tight, things are slightly different now: according to the latest reports, the labor market is slowly cooling down.

The risk of a recession always seems closer. In this article, we will cover the most evident signs of a recession in 2023.

Recession definition and current state of US markets

A recession consists in a prolonged economic downturn. This phenomenon is well known to our economies: according to the World Bank, there have been 14 recessions since 1870.

Unfortunately, it’s not easy to predict a recession, and it often happens that this prolonged economic and financial downturn is recognized only after it’s over.

Possible signals of a recession are negative macroeconomic events, increased investments in assets considered as safe-havens, high inflation. The consequences are usually seen long after a recession ends – for instance, unemployment rates and people’s spending remain low.

The current economic and financial environment is showing negative signs that could signal a recession. Let’s see what’s going on.

Inverted yield curve – a tool used to predict recessions

A yield curve can be defined as a tool that signals what are the different interest rates paid by debt instruments that have similar levels of risk but different maturity dates – that is, the time when the investments have to be repaid to investors.

Instruments with long-term maturities are usually considered riskier – for the simple reason that many things can occur in several years: for example, if a debt instrument has a 10-year maturity, it’s more subject to macroeconomic negative events. For this reason, interest rates paid to investors are usually higher if compared to those paid for short-term instruments.

A normal yield curve slopes upward, indicating that long-term interest rates are higher than short-term interest rates – that is, it signals a healthy, “normal”, situation.

When a yield curve is inverted, because it slopes downward, it represents a negative sign: it signals that short-term interest rates are higher, because the demand for short-term credit increases. At the same time, long-term rates are lower – consider that regulators adjust interest rates according to macroeconomic conditions, decreasing them in case of recession and increasing them in case of high inflation (what's happening right now).

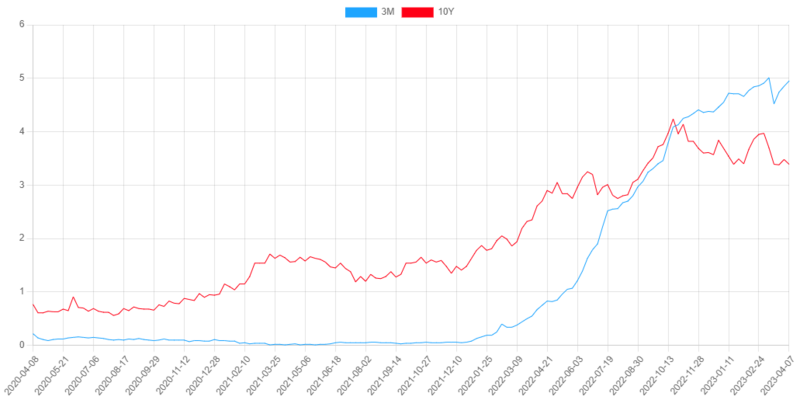

Considering US treasuries, we’re currently witnessing a situation in which short-term interest rates are higher than long-term interest rates.

Source: US Treasury Yield Curve. As shown, 3-month maturity yields are above 10-year maturity yields.

The stock market looks weak at the moment

After an uptrend that began in 2009, the S&P 500 Index shows the first signs of weakness.

This monthly chart shows that the highest point of the uptrend was touched between December 2021 and January 2022, and that now, bulls weren’t able to drive the market up – in spite of the fact that their efforts (represented by volume) were slightly above average in March.

Source: TradingView

Gold seems to be the choice of investors – and even ChatGPT suggests to buy

Gold is globally known as a safe-haven: in times of economic and financial uncertainty, this is what investors look for to own something that can work as a hedge against inflation.

At the time of writing, gold is traded at around $2,023 per ounce – just -2.51% less than the all time high reached by gold after the breakout of the pandemic, traded at over $2,075 per ounce in August 2020.

If gold advocates usually suggest an allocation between 5% and 10% of investors’ portfolios, the most bullish on gold seems to be ChatGPT: the AI phenomenon created by OpenAI, replied with a 20% allocation when asked to create a “recession proof” portfolio.

Jobs openings and hires slightly decreased

As we mentioned, the labor market in the US is still tight – meaning that there are more job openings than workers. As we explained in our article about the effects of inflation on the labor market, there is an inverse correlation between inflation and unemployment, and an inverse correlation between interest rates and inflation: when interest rates rise, inflation decreases; when inflation is high, unemployment rate is low.

So far, the tight labor market hasn’t helped to decrease inflation, but the measures taken by the Fed seem to show the first effects on the market.

As reported by the US Labor Department, in February there were less job openings than those registered in January 2023: the so-called JOLTS, the Job Openings and Labor Turnover Survey, shows that there were 9.931 million openings, against the 10.563 million openings of January – -6.36%. Compared to February 2022, the decrease is even higher – -16.82%.

Also hires decreased – -2.66% compared to January 2023, -10.34% compared to February 2022.

How fintech reacts to the recession

If there’s a difference between the current crisis and the 2008 crisis, it’s that we now have more tools.

The fintech industry offers many tools and solutions to those who want to cope with uncertain economic times. An interesting article published by Forbes, shares that there are a few fintech trends for 2023.

How to define fintech? Here's an article that can help you understand financial technology:

Actually, fintech continues to grow – even if its sectors grow at a different pace and develop differently according to markets in different regions.

Among the trends we want to mention for the purpose of this article, there are things we’re already observing:

- An increasing interest in DeFi solutions – which are out of the control of governments and regulators;

- An increasing use of fintech-based credit products – which offer less strict conditions and need less requirements if compared to the traditional credit products.

Final Thoughts

In these times of economic and financial uncertainty, businesses are in trouble because of the increased interest rates (used to fight inflation), which tighten credit and erase investments and savings.

Currently, there are many signs that indicate a recession, but as a positive note, we now have more tools to cope with crises and uncertainty.

If you want to discover fintech news, events, solutions and insights, subscribe to the FinTech Weekly newsletter!