As customers have generally grown to demand quicker settlement times, alerts, and consolidated reporting, this new norm is causing change for conventional payment kinds including checks, credit, debit, prepaid, and the like.

The market for real-time payments has been expanding quickly. According to a study by ACI Worldwide and GlobalData, there were more than 118 billion real-time transactions in 2021, up from 70 billion in 2020. In 2026, that amount is projected to increase to over 427 billion, or over a quarter of all electronic payments made worldwide.

Consumer and company demand for real-time payments has increased as the macroeconomic environment becomes less favorable and interest rates begin to climb.

____________________________________________________________________________

“When rates were low, nobody really cared if it took days to transfer their money to someone else, but now rates are rising, people are chasing interest rates,” says Peter Harmston, head of payments at KPMG UK. “Because of the macro climate, people are starting to ask questions: why isn’t my money moving quicker, and who is taking advantage in between? As consumers, that is a very different conversation than we would have had nine months ago.”

__________________________________________________________________________

Real-time payments are becoming more and more crucial for managing liquidity and working capital for businesses, whether they are major corporations or small and medium-sized enterprises (SMEs).

Real-Time Payments; The New Cash?

As long as money has existed, real-time value exchange has existed as well. Since they were the first form of money, notes, and coins have aided business for around 5,000 years. Cash delivers payment certainty and promotes commercial transactions with little friction since it is widely used and trusted.

Payment delays paradoxically became the norm as financial markets got more complex and linked. Innovative financial tools that took longer to clear, such as checks and promissory notes, hampered settlement. Similar to how mainframe computers opened up new possibilities for electronic payments, batched-based processing set clearing periods and required payment schedules.

Through the use of real-time payments (RTP), these technological barriers are removed, enabling people, businesses, and financial institutions to send money instantly and around the clock to friends, customers, and businesses.

Real-time payments not only improve the speed and efficiency of digital payments, but they also herald a new era of contextualised commerce, allowing irreversible payments to be made exactly where and when they are needed. This is especially important when using an app or the internet to do business. These days, a digital experience devoid of quick payment is likely to be subpar, fall short of customer expectations, and create a disadvantage for a business.

How does a real-time payment system work?

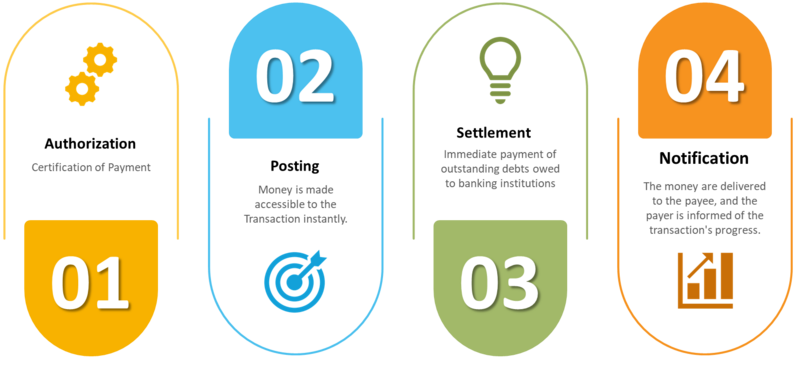

The majority of real-time payment systems currently in use offer an immediate, round-the-clock service for interbank electronic financial transfers that may be started on any of a variety of platforms, including mobile devices, tablets, digital wallets, and the internet. In such a system, a low-value real-time payment request is made to provide secure transaction posting with quick notification features and interbank account-to-account cash transfers.

Certain key aspects of Realtime Payments:

Potential benefits of Real-Time Payments

1. Increasing Effectiveness

RTP improves the efficiency of several conventional payment procedures. Some payment methods can take days to reach recipients and settle in their accounts, even though customers may already assume their cash is transmitted and received in real-time. Since bank account balances might not be updated, this situation could be confusing. With real-time account balances and up-to-the-minute transaction records, RTP delivers assurance and clarifies cash management.

RTP has the potential to enhance people's lives in several ways. For instance, cash received from selling a property or selling investments is instantly available. People may put money into a broker account online, trade equities instantaneously, and track cash positions accurately in real time.

2. Encourage Innovation

RTP, however, also introduces new business opportunities. Take, for example, peer-to-peer ride-sharing. Customers may use cards to make payments without real-time payment, but it might take days for the transaction to clear and for the cash to reach the intended recipient. RTP eliminates friction and bridges the distance between a business, its clients, as well as its staff. In this scenario, payment is made immediately, the employee is paid sooner, and everyone is content.

3. Building Relationships Out of Transactions

Supporting communications between the payer and payee is another crucial feature of real-time payments. Examples include:

- Inquiry regarding payment

- Acknowledgement of payment

- Credit transfers, sometimes known as "push payments,"

- Services for remittance guidance

With the help of these technologies, the payer and payee may add more flexible information to the payment to enhance it, improve transparency, and foster communication. Real-time processing creates a payments ecosystem where banks, retailers, and customers can all share information to improve productivity, provide value, and transform the way things are done.

Benefits of Real-Time Payments for Businesses

RTP allows for quicker funding transfers, which enhances forecasting and financial management for businesses. For small firms, where managing cash flow and liquidity is critical, this is particularly important. The epidemic brought to light the value of money, having access to capital, and managing financial flow. A small firm may be certain of fulfilling its immediate obligations, reducing borrowing, and making the best use of extra cash if it has a real-time snapshot of its cash situation.

However, the huge business also reaps rewards, especially in cases where there are extensive supply chains or international payments. Real-time payments allow for comprehensive cash management, working capital management optimization, and the orchestration of payments utilizing e-billing or request-for-payment features.

Real-time payments present a chance for many firms to boost transparency and streamline their payment procedures, which now frequently include checks and the automated clearing houses' five-day workweek. Example: As soon as the job is over, employers can pay contractors in full. Considering 9%[1] of American people presently or recently working as gig workers, timely payment is becoming increasingly crucial. Payroll on demand is made possible by real-time payments, and everyone gains from the improved flexibility and convenience.

What is driving the growth of real-time Payments?

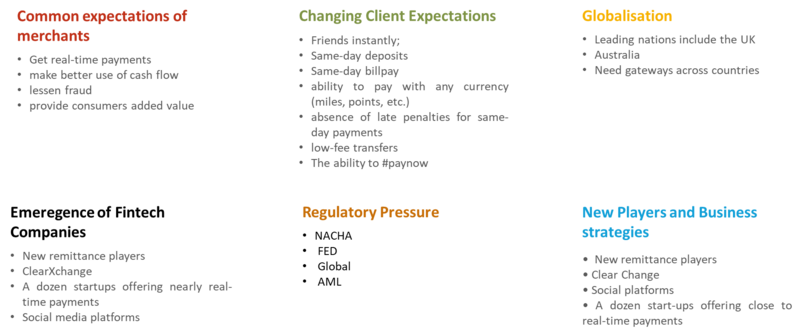

Over the past ten years, there have been significant advancements in both technology and business models. Perhaps most significantly, there are increasing expectations from retailers and customers. These expectations range from new payment platforms and solutions to revised rules addressing payment effectiveness and security.

- Technology innovation: Smartphone penetration has reached 70% in rich economies, while feature phones are often replacing wallets and currency in several emerging economies. Due to catalysts like social platforms, digital currencies, and near-field communication (NFC) based payments, new domestic person-to-person (P2P) payment providers are constantly emerging. Rapid industrial transformation is being fueled by rapid technological progress.

- Brand-new participants and business models: New start-ups, spin-offs, and collaborations are bringing new possibilities for the payments sector, which was formerly dominated by the established banking industry. Many new FinTech businesses have emerged in recent years, with an emphasis on mobile payments. The emphasis is typically on new services, such as security with fraud detection and authentication, enhanced user experiences, or providing small companies with speedy access to cash when their line of credit is granted. The next step for these companies would be to decide whether real-time payments will become a crucial component of their operations and how to create an operational model that will enable them to offer their services as efficiently as possible.

- Expectations of merchants: Many small companies and major shops alike are looking for real-time payment to improve their cash flow management, prevent fraud activity, and deliver more value to their consumers in addition to payment certainty and cheaper transaction costs.

- Expectations of consumers: Many consumers today demand practically everything to be available in real-time due to the rapid advancement of technology, yet payments sometimes appeared to be trapped in the past. The era of on-demand fulfilment is here to stay. The proposition is that paying bills or sending money to contacts shouldn't take more than a few clicks or taps, and that money should be available to be assessed as early as possible.

- Regulatory pressures: Regulators are under pressure from all across the world to speed up payments. To speed up real-time payments in the US, the Federal Reserve Bank and the National Automated Clearing House Association (NACHA) are developing a roadmap and offering incentives.Real-time payments are supported by laws in various developed nations. Consumers and the government stand to gain from this since the government can more easily track activities and improve the economy's general flexibility.

- Globalization: Generally speaking, customers and businesses worldwide anticipate the same straightforward payment and transfer experience. For a wide range of use cases and in many different countries, more effective payment systems have already been successfully deployed. As more nations embrace real-time payments, pressure on other nations to prepare the ground and facilitate quick payments is expected to grow.

Opportunities and Common Challenges for Financial Institutions

With the help of more effective, safe, and engaging commerce experiences, real-time payments may provide businesses with the chance to attract, serve, and keep consumers. Convergence between real-time payments and e-commerce has attracted new players to the industry who are creating practical, straightforward solutions. With so many competitors in the market, banks may face a variety of difficulties, including the risk of losing clients to other financial service providers.

Banks should think about how to effectively offer a comparable product that enables the monetization of related services, encourages customer spending, opens up new payment options, and increases income. Banks that participate in real-time payments may be able to lower the typical end-to-end costs of payment transactions and allow novel payment services that provide greater value to both consumers and companies by having a significant number of payments originate and be received electronically. Real-time payments being used to assist the unbanked is another illustration. Banks can reach new clientele by developing potential real-time payment activity-capturing tools.

Actions to be taken going forward

In the US, the path toward quicker, more real-time payments has already started. Financial institutions may have concerns about when and how to embark on the trip in light of the Federal Reserve's further support. The vast majority of consumers and companies, according to research by the Federal Reserve, want real-time or almost real-time payments, suggesting a demand that is not presently being satisfied by any of the players in the payment ecosystem.

Real-time payments will probably have a profound impact on how we do business and trade. When that time arrives, customers will be able to take advantage of the ease of making last-minute, penalty-free payments for their bills. A rise in funding options could be advantageous to businesses. Better services might be offered by financial institutions.

The world's economies may be more erratic than ever. We forecast that real-time payments will probably lead to new consumer purchasing and behavior patterns, which will increase income for the payment players that are well-positioned to benefit from this development, even though obstacles still stand in the way of achieving this ideal future state.