The importance of finance lies in the fact that it is needed basically for everything.

From managing personal finances to managing business finances and reading news, financial literacy is something to take into high consideration to avoid unnecessary risks and to better understand the world that surrounds us.

Recently, the pandemic, the increased activity of regulators, and the banking crisis posed some questions, and there’s mainly one question we’d like to answer: when a population is financially educated, is it able to navigate everyday life even when economic and financial conditions are adverse?

The importance of finance: how to use financial literacy to navigate the world

At the end of the day, it all comes down to two principles: saving and investing.

- Pay yourself, first: you might have heard this fundamental rule many times. “Pay yourself first” simply means that you prioritize your well-being – to be more specific, we’re talking about your financial well-being in this case: whatever the goal you have to improve your financial future, prioritize it. For instance, if you need to upgrade your skills – so, you need to invest in your education – do it before thinking about any other expense.

- Invest in yourself: investing in yourself is a direct consequence of the rule “pay yourself first” – and, at the same time, it is the first step towards financial freedom. Usually, paying yourself first, or investing in yourself, starts the same way: how much are you able to save to create a fund that can help you reach your goals?

- Avoid bad debt: the capability of saving is strictly related to how savvy you are when it comes to investing. A bad debt has at least two conditions: you’re not able to repay it, and you created it to invest in something that doesn’t give any return. That’s why creating a debt to buy the trendiest pair of shoes is not the same as creating a debt to buy an expensive course that can lead you to a well-paid job. The importance of finance – and the way you manage your personal finances – can help you make the right choices and, as mentioned, avoid useless risks.

- Having an emergency fund. Also in this case, the right choices can lead you to better manage your funds and cover any unexpected expenses if you create for yourself an emergency fund.

Ultimately, finance is important to live peacefully.

If we consider all the previous points and put them into the current global financial context, we can start answering our question.

- As a rule of thumb, it is considered that each person should have enough savings to cover the expenses for 3 to 6 months. This is an interesting amount of time if you consider that, on average, it takes the same number of months to get a new job. If we consider that we don’t always live in times when global financial and economic conditions are “normal”, you should know that a recession lasts – on average – 11 months. So, the more you save the better.

- An important part of any crisis is panic. People who are sufficiently financially savvy to manage their funds will be less prone to any external change in the global economic and financial frameworks. Panic usually spreads thanks to news, and this leads us to another point: the importance of finance for businesses and institutions has direct consequences on people, but if people know how to read the news, they’ll be less subject to any piece of content and will make decisions based on objective parameters, without suffering panic. 2008 is a great example to take into account. At the end of the day, the crisis started in the real estate sector: people profited from risky assets just because they were easy to get. But understanding floating interest, emergency funds, and knowing how to manage risk, would have saved many of them.

Why financial literacy is important to read news

A total lack of financial literacy can make it hard also to carry out simple tasks like reading everyday news – for the simple reason that it becomes harder to understand it.

To give you a practical example, let’s analyze what happened with the Silicon Valley Bank and why news contributed to changing people’s perceptions.

With the beginning of the pandemic, fintech (financial technology) – and the tech industry in general – witnessed impressive growth, since this was basically the industry that could help businesses find new solutions and use different payment methods and financial products, and at the same time, it was the industry that could allow people to continue managing their finances and get products and services without leaving their homes.

Silicon Valley Bank, being one of the most important reference points for fintech companies and startups, received large deposits and, like any other bank, invested them.

The bank invested these funds in the assets that are considered among the safest – US Treasury Bonds.

So, from this point of view, the bank didn’t do anything weird or purposefully risky. But… it invested them in long-term bonds.

And here’s the point – if you want to know why long-term bonds are considered riskier and how dramatic it can be when they fall below short-term bonds, you can find a complete, easy-to-read explanation in our Diary Of A Recession.

The “duration risk” didn’t reward SVB.

The duration risk is defined as the risk caused by possible changes in the value of an asset because of interest rates. In this case, long-term bonds are more prone to this risk, because there are more possibilities for interest rate fluctuations in 10 years than in 3 months.

To get back to our example, with rising inflation, digital assets under the spotlight of regulators, and crypto businesses’ failures because of the (natural) market downturn, the Fed decided to raise interest rates. And the value of long-term bonds fell.

At this point, SVB decided to launch a new share sale – worth $2.25 billion ( $1.25 billion in common stocks, $500 million in depository shares, and the $500 million common stocks sold to General Atlantic) – to strengthen its capital. It was March 8, 2023.

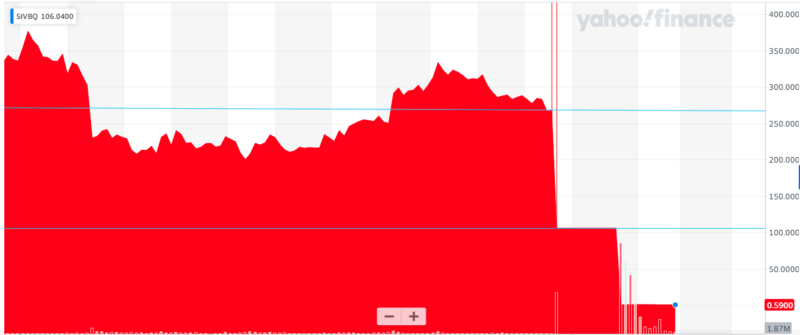

As soon as the news became public, investors started panicking: the price of the SVB Financial Group (SIVBQ) stock went down by 60.41% – from $267.83 to $106.04. It was March 9, 2023:

Source: Yahoo! Finance

That very day, Greg Becker – CEO of Silicon Valley Bank – held a conference and he asked clients to stay calm – that is, don’t panic.

But in the meantime, news about any possible issues related to the solvency of the bank was already making investors suggest to each other to move their funds.

It’s like if someone suddenly asks you for $3,000, and you only have $100 cash in your wallet: even if you have the other $2,900 in a savings account, and you just need more time to get them, it doesn’t matter. You weren’t able to meet such a sudden request.

At a larger scale, it’s what happened to Silicon Valley Bank: it had to face withdrawal requests for $42 billion in one day, while the collateral it could use to borrow money and cover sudden withdrawals was losing value – because of higher interest rates, and the very company was losing value – because of the sell-off.

All this could only have one ending: failure.

We’re not saying that SVB doesn’t have to take its share of the blame:

- Investing in long-term bonds can still be risky,

- Not all funds were insured.

At this point, the US government took control of SVB: it was shut down and the Federal Deposit Insurance Corp. (FDIC) created a bridge bank. It was March 10, 2023.

In the space of three days, a bank collapsed. And it wasn’t just any bank, it was the 16th bank in the US and one of the most important banks in the fintech space. What if investors avoided the bank run?

What happens in this cases was extensively explained by Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig, who won a Nobel Prize in 2022.

Basically, what they say is that the best way to use savings is investing, but when it comes to banks, a conflict arises, because – at the same time – people want to have immediate access to their money.

If rumors about any possible difficulty start spreading – we could replace the word “rumors” with “news” – people’s panic causes bank runs, and this is a great example of what is known as a “self-fulfilling prophecy”: basically, it is precisely the bank run that causes the crisis.

Final thoughts

What we analyzed in our example is what happens in cases of huge financial catastrophes, but it doesn’t mean that this doesn’t happen, on a minor scale, in everyday life.

What if you do not have enough funds to cover unexpected expenses? What if you don’t have enough information and knowledge to avoid panic? What if any piece of news can change how you perceive your financial management?

At the end of the day, it’s always about people – even CEOs and top managers of top funds are people, and there is an extremely large amount of books related to the psychology of finance.

The point is that it is important to understand finance, and its importance will help both people and businesses to safely navigate the world.

In the meanwhile, if you want to test your financial literacy, here’s a sampling of the questions asked in the Personal Finance Index conducted by the GFLEC and TIAA. Have fun – and don’t panic.

If you want to know more about fintech and finance, and discover fintech news, events, trends, and insights, subscribe to FinTech Weekly Newsletter!