The ascendance of unicorns in the buy-now-pay-later space like Klarna and the dominance of payment solutions in the fintech agenda point to the overarching embedded finance trend. The term was first used in the payments industry which is now making its way up to the value chain of financial services like lending, wealth, cards and other related areas. The popularity of embedded finance has drawn attention to an unexplored market for embedded wealth.

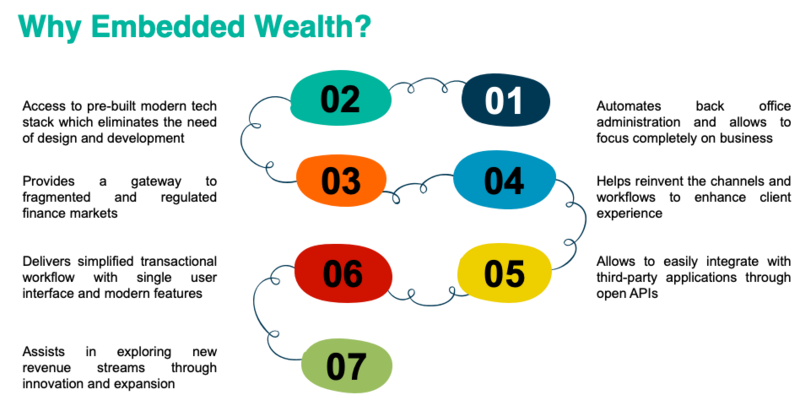

It enables platforms to effortlessly incorporate investment products and services into current offers or create new propositions based on an investing stack given through API.

API-enabled wealth technology is now widely accessible at a lower, more affordable price for many. In addition to helping companies to reach new and previously underserved customers with their goods and services, embedded wealth providers are also enabling improved access to capital markets, lower cost access to portfolio management, and robo-advisor technology. Also, initiatives like PSD2 and open banking are popularising the creation and use of APIs fostering better laws and innovation.

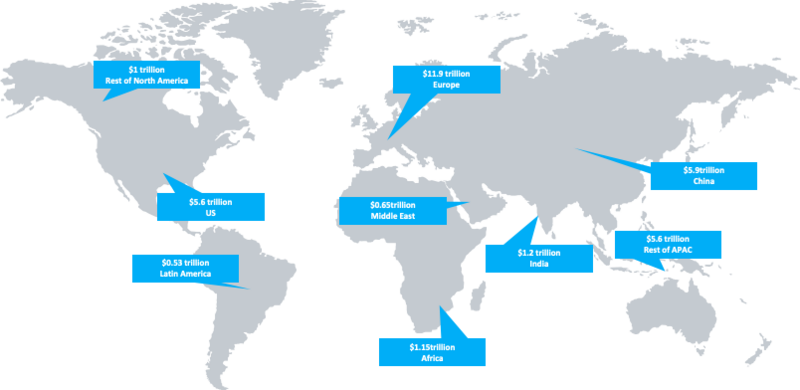

The embedded wealth market has the potential to bring up to $33 trillion in assets. As per the research by Additiv, embedded wealth solutions might generate $100 billion in fees. It could not be long until you can buy stocks and shares together with your meal deal of crisps, a sandwich, and a drink because integrated wealth technology is spreading its wings to expand the influence to the smaller details of life.

Adding Embedded Wealth To Your Shopping Cart

As consumers get accustomed to using financial products provided by well-known brands, there is a genuine opportunity to increase access to investing through embedded wealth.

Companies like Drivewealth and Alpaca are revolutionising the investment industry both domestically and internationally. They provide B2B wealth platforms with modular solutions for fractional shares that are accessible using APIs. They now have non-financial players among the hundreds of corporations that have integrated into their platforms.

The development of this open investment infrastructure facilitates business product development and consumer access to the financial markets. Drivewealth has millions of subscribers in the UK and around 15 million customer base worldwide despite not yet being a household name. Drivewealth also empowers the UK-based powers Tulipshare, the first activist stock brokerage that debuted in 2021.

A variety of low-cost, mass-market brokerage services that weren't available ten years ago are now in demand - facilitated by embedded wealth. Analysts foresee that financial institutions, challenger banks, more payments businesses, and even corporations like Walmart consider entering the embedded wealth market. With the advent of banking-as-a-service (BaaS), financial and non-financial companies can easily integrate banking services into their ecosystem. Some of the BaaS providers such as Railsbank, Solarisbank, Treezor, Green Dot, etc. are disrupting the traditional wealth management offerings by empowering fintech to innovate wealth offerings for various customer groups.

However, challenger banks seem to be eager in embedding wealth as compared to traditional banks which are moving slowly to adapt to the changes brought in by financial technology. A wide range of wealth products will be offered through these platforms towards the end of 2022. A challenger bank finds it easy to integrate an API into its banking app to provide a streamlined technology stack and the ability to design financial products swiftly. The product offering of a banking app may thus be easily expanded through embedded wealth, which should increase user retention and possibly attract new users to the platform. A wide range of products and ongoing new features may be both a key differentiation and a way to defend the cost of the service in a market where many service providers use a freemium model.

For a business (the majority of fintech) looking to monetize its customers through subscriptions or recurring payments, adding new goods and services will make the deal more alluring and sticky for members which are crucial for boosting subscriber growth. Most importantly, investment has lifetime durations, thus this can provide subscribers with long-term sustained value.

Financial services have always had better margins than other businesses. For firms that understand the opportunity, billions of dollars await in profits. New-age companies shouldn't undervalue the level of competition and the regulatory complexity involved in handling money and assets.

Existential issues might emerge if legacy financial institutions lose market dominance and relevance in the new embedded landscape if they remain ignorant of the threat.

In light of this, a change is imminent and our perception of wealth and money will change drastically.

Three Lucrative Business Opportunities for Embedded Wealth

The different use cases within the bracket of embedded wealth open the doors to the high dollar value market and highlight the technology that could be influential in driving embedded wealth solutions to the market.

The first and foremost use case involves the integration of personal finance management features into shopping and subscription management experiences. Integrating features of personal money management into shopping and subscription management experiences is the first and most apparent use case. The inclusion of personal finance management components might really support the user by controlling their spending, in contrast to buy-now-pay-later systems that capitalise on feelings of urgency and promote impulsive purchases. The merchant would also benefit since the integrated wealth solutions might assist them in demonstrating to customers that purchasing the product will save them money by illustrating its quality, sustainability, and longevity. Likewise, personal finance management features could stimulate the customers to select the subscription models which are appropriate for their usage – that could allow the merchant an opportunity to gain stable cash flows time and again.

Pension planning as a component of the job experience is another intriguing opportunity/business model for embedded wealth solutions. The incorporation of pension planning toolkits into a company's intranet may benefit the brand recognition of the employer, the efficiency of the treasury's pension accounting, and the proactive and productive retirement planning for employees. The employee may be effectively guided through the nuances of the retirement savings choice by modern interactive pension planning systems, and they can then be assisted in choosing the option that best fits their unique circumstances. Even though the accounting departments often handle the preparations for the employees' retirement, increasing employee knowledge of pensions is rarely seen as a way to boost happiness among workers.

The third opportunity focuses on providing seamless financial management for small businesses. Smaller businesses could struggle with liquidity management in their daily operations whereas larger businesses can afford to employ skilled teams of accountants. For instance, combining corporate credit and payments helps guarantee the efficient and simple payback of small enterprises' interest payments and loans. The plan is to use a portion of the proceeds from sales to pay off the debt right away. For instance, if a pizzeria spends €10,000 on a new stove, they guarantee that 10% of each pizza sold would go towards repaying the credit. In this scenario, embedded wealth might assist business owners in ensuring the viability of their operations by simplifying the loan terms and payback schemes.

Embedded wealth has the potential to add significant value to the existing system. Fintech is re-designing finance services fostering innovation and altering the traditional finance system. Evolving customer expectations have provided favourable conditions for this new chance to become widely accepted. Adoption of this market will transform the old-rooted set-up and make it beneficial for everyone- traditional banks, challengers and consumers. It will empower both merchants and customers with innovative choices and opportunities in the embedded wealth area.