A Brief Overview of Generative AI

Generative AI refers to algorithms that can create new data samples by learning patterns from existing data. At its core, generative AI involves the development of algorithms that can create or generate new content, such as text, images, code, and even music, based on the patterns and structures identified from a vast array of input data. This type of AI has become increasingly important in the banking industry due to its potential to improve efficiency and accuracy in various applications.

The Importance of AI in the Banking Industry

AI has significantly impacted customer service, enabling banks to provide personalized, efficient, and seamless experiences through chatbots, virtual assistants, and natural language processing. Additionally, AI has bolstered fraud detection and prevention measures by employing machine learning algorithms and pattern recognition techniques. Risk management has also greatly benefited from AI's predictive analytics and risk modeling tools, allowing for better decision-making and risk mitigation strategies.

Finally, AI-driven robo-advisors have democratized access to financial advisory services, empowering customers to make more informed decisions about their financial future. As AI continues to evolve, its potential to drive positive change in the banking sector is immense, ushering in a new era of efficiency, security, and customer satisfaction.

Introduction to Cutting-Edge Generative AI Models

Next-generation generative AI models are pushing the boundaries of AI applications in the banking industry. These models have evolved from the early days of generative adversarial networks (GANs) and variational autoencoders (VAEs) to more advanced models, such as OpenAI's GPT (Generative Pre-trained Transformer) series. Advanced models like OpenAI's GPT series and other next-generation models have the potential to bring significant benefits to the banking industry.

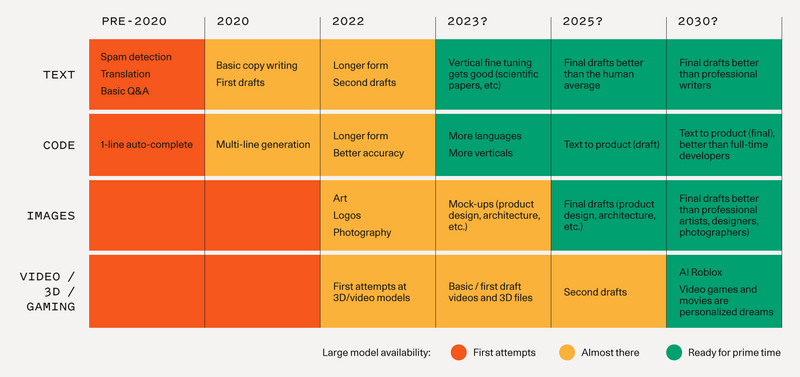

Chart source: https://www.sequoiacap.com/article/generative-ai-a-creative-new-world/

As AI models advance, they are significantly impacting various domains, including text, code generation, images, speech synthesis, video, and 3D modeling. Improved natural language models enable better short/medium-form writing, while code generation tools like GitHub CoPilot boost developer productivity and make coding more accessible. The popularity of generated images and their diverse styles demonstrates their potential in creative applications. Speech synthesis is steadily improving for consumer and enterprise uses, while video and 3D models show promise in creative markets

Recent Developments in Generative AI Research: Research in generative AI has been growing rapidly, with numerous breakthroughs in recent years. Advances in techniques like unsupervised learning, reinforcement learning, and transfer learning have contributed to the development of more sophisticated and powerful AI models.

Transforming the Banking Industry with Generative AI

In recent news, FinTech startup Stripe announced its integration with OpenAI's latest GPT-4 AI model, highlighting the growing adoption of advanced AI technologies by financial institutions. This collaboration will enable Stripe to leverage GPT-4's capabilities to improve various aspects of its services, including fraud detection, natural language processing, and customer support. The partnership exemplifies the transformative potential of generative AI in the banking sector, with numerous applications that can streamline processes, enhance security, and deliver personalized customer experiences. Furthermore, industry leaders are recognizing the value of generative AI in shaping the future of banking.

Intelligent Credit Scoring and Risk Assessment

Traditional credit scoring methods often rely on outdated or limited data, leading to inaccurate assessments of borrowers' creditworthiness. Generative AI transforms this process by leveraging vast amounts of data from multiple sources, including social media, transaction history, and alternative financial data. By analyzing this wealth of information, AI-driven algorithms can create a more accurate and nuanced credit score, enabling banks to make better-informed lending decisions.

Risk assessment is another critical area where generative AI excels. By continuously analyzing data patterns and trends, AI systems can identify potential risks and provide early warnings, allowing banks to take preventive measures and mitigate potential losses. This proactive approach not only safeguards the banks' interests but also fosters a more stable financial ecosystem.

Hyper-personalized Customer Experience

Generative AI is a game-changer when it comes to enhancing the customer experience in banking. With the ability to analyze and learn from vast amounts of customer data, AI-driven systems can create highly personalized experiences tailored to individual preferences and needs. This level of personalization extends to product recommendations, targeted marketing campaigns, and customized financial advice.

Additionally, generative AI enables banks to deploy intelligent virtual assistants that can understand natural language and provide instant, accurate responses to customer inquiries. These virtual assistants can handle a wide range of tasks, from answering account-related questions to providing financial advice, ultimately leading to faster resolution times and higher customer satisfaction.

Fraud Detection and Prevention on a New Level

As financial fraud becomes increasingly sophisticated, banks need to invest in advanced technologies to stay one step ahead of the criminals. Generative AI offers unparalleled capabilities in detecting and preventing fraudulent activities. By analyzing large datasets and identifying patterns that may indicate fraud, AI-driven systems can quickly detect anomalies and alert banks to potential threats.

Moreover, generative AI can adapt to evolving fraud patterns, continuously updating its detection algorithms to stay ahead of the curve. This proactive approach not only helps banks minimize financial losses but also fosters trust and confidence among customers, who can rest assured that their financial information is secure.

Smarter Investment Management and Trading

Generative AI is revolutionizing the asset management industry by offering innovative solutions for smarter investment management and trading. Enhanced portfolio optimization, advanced risk management, improved investment decision-making, efficient trade execution, and adaptive trading strategies are some of the key benefits of incorporating AI-driven algorithms in the asset management process. By analyzing vast amounts of data from diverse sources and uncovering hidden trends and relationships, generative AI empowers asset managers to make data-driven decisions that align with their clients' risk tolerance and financial goals. In addition, AI-driven systems enable asset managers to optimize trade execution, minimize transaction costs, and adapt their strategies to the ever-changing market conditions, ultimately delivering better performance for their clients.

Navigating the Challenges of Generative AI in Banking

A focus on data quality and addressing data scarcity is required to accomplish this. Ensuring data quality is vital as AI models rely on vast amounts of accurate and up-to-date information to make informed decisions. Banks need to invest in robust data management systems, data cleaning processes, and partnerships with reliable data providers to create high-quality data sets. Data scarcity, on the other hand, can hinder the performance of AI models, especially in niche areas or when analyzing new financial products. To tackle this issue, banks can explore techniques like data augmentation, synthetic data generation, and transfer learning to enhance the available data and improve AI model performance.

Overcoming ethical concerns and bias in AI models, as well as compliance with legal and data protection requirements, are also critical challenges in implementing generative AI in banking. Ethical concerns include the potential for biased decision-making, transparency, and the impact on employment. Banks need to adopt responsible AI practices, such as auditing algorithms for fairness, providing explainability, and ensuring human oversight. Compliance with legal and data protection requirements is essential to maintain customer trust and avoid penalties. Banks must integrate privacy-by-design principles in AI systems, implement strong data security measures, and adhere to local and international data protection regulations, such as GDPR and CCPA, to ensure a responsible and compliant use of generative AI in the banking sector.

While AI can automate many tasks, human expertise remains essential in the banking industry. Banks must strike the right balance between automation and human intervention to ensure optimal results and maintain customer trust.

Preparing for a Future Shaped by Next-Generation AI Models

As AI continues to evolve and shape the banking industry, banks must remain agile and adaptive to stay competitive. This involves staying up-to-date with the latest developments in AI research and technology and exploring new applications that can drive growth and innovation.

In order to fully harness the potential of advanced AI models, traditional banks must collaborate with FinTech startups, which are often at the forefront of innovation. These partnerships can help banks accelerate their AI adoption, drive new product development, and enhance their service offerings.

For banks to stay ahead in the AI-driven landscape, they must invest in AI research and development. This includes funding academic research, establishing partnerships with AI research organizations, and nurturing in-house AI talent.

As AI becomes more integrated into banking processes, banks must invest in upskilling their workforce to prepare for the future. This includes providing continuous training and development opportunities to ensure employees are equipped with the skills needed to thrive in an AI-driven environment.

Conclusion

The rapid advancements in generative AI models present both opportunities and challenges for the banking industry. By embracing these cutting-edge technologies and addressing the associated challenges, banks can drive innovation, improve efficiency, and deliver better customer experiences. As the industry continues to evolve, banks that invest in AI research, collaborate with FinTech startups, and develop a future-ready workforce will be better positioned to succeed in the AI-driven landscape.